If your business is in colorado springs and Springs sales tax license or if located outside the city a copy of the state retail sales tax license.

Colorado Springs Ranked No 3 Best Place To Live By Us News World Report Colorado Springs

A sale may be exempt due to the type of product sold (food for home consumption, prescription drugs, gasoline, etc.), the status of the purchaser (governmental entity, charitable, religious, etc.) or the nature of the sale (sale for.

Colorado springs sales tax license. Sales/use tax the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in effect. Sales tax license application sales tax. The state sales tax rate in colorado is 2.9%.

A special event is a retail sales event located outside of a business' physical location. The sale or purchase of an article of tangible personal property is subject to city sales or use tax unless the sale is exempt under the city code. Business may not be conducted until a business / sales tax license has been issued.

Apply for a sales tax license online in city of colorado springs seamlessly with papergov. Temporary sales tax license $20.00 license fee (city of colorado springs) on average this form takes 8 minutes to complete. For all questions regarding business licensing, contact the city clerk's office.

File and remit 6.9% sales tax to the colorado department of revenue for sales during the month prior or quarterly per application, the cdor can receive documents and payment online; If the sale is for the licensed retailer's own use or consumption, rather than for resale, it is not exempt. Sellers at special events will need to obtain a special event license from the department prior to the event.

The city of colorado springs is home rule. Nevada ave., suite 101, colorado springs, colorado. Sales shipped out of the city and/or state

File and remit 4.9% town lodging tax collected to the town of pagosa springs on the 20th of each month for sales during the month prior A sales tax license is used for collecting and remitting sales tax that is collected by the colorado department of revenue. However, sales tax is also collected for counties, cities and special districts.

Retailer engaged in business in city However, if you sell directly to consumers in a store and/or your own website, in addition to using a marketplace facilitator, you are required to have a sales tax license. While colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes.

The exact sales tax rate is determined by adding the various rates that apply at the location where a sales transaction is completed. 20 business / sales tax license application. Days for processing and approval.

For general business or retail sales tax. How to make a payment. A retailer uses this license to collect and remit city sales tax, lodgers tax, automobile rental tax, use tax, motion picture theater taxes and/or bicycle excise tax

Ø a sales tax license is required for any person engaged in the business of selling tangible personal property or taxable services at retail in the city of colorado springs. Certain tax records are considered public record, which means they are available to the public, while some. Tax records include property tax assessments, property appraisals, and income tax records.

Business is in colorado springs and you have a customer in colorado springs, you need to have a city of colorado springs and department of revenue sales tax license to collect a tax rate of 8.25%. Each physical location must have its own license and pay a $16 renewal fee. These applications & certificates do not cover the colorado department of revenue, cities other than the city of colorado springs or counties within the state of colorado.

The temporary sales tax license $20.00 license fee (city of colorado springs) form is 2 pages long and contains: Owners may be subject to a different tax rate if the vehicle was purchased within the entity where they reside (fountain, manitou springs, or monument). The department does not require marketplace sellers who sell exclusively through a marketplace facilitator to have a state sales tax license.

Payment options by tax type. Colorado springs tax records include documents related to property taxes, business taxes, sales tax, employment taxes, and a range of other taxes in colorado springs, colorado. City of colorado springs, sales tax, p.o.

The city of steamboat springs is a home rule municipality with its own municipal code, collecting its own sales tax. Must supply a copy of driver's license. This means the city is authorized to levy and collect its own sales and use tax.

Examples include, but are not limited to craft fairs, art walks, festivals, holiday markets, antique shows, and garage/yard sales. For a retail sales tax license, make check payable to the city of colorado springs. Sometimes taxpayers refer to this as a business registration, but it is an application for a colorado sales tax account or sales tax license.

How much does a sales tax license cost in colorado? Be it property taxes, utility bills, tickets or permits and licenses,. Steamboat springs' sales tax is levied on tangible personal property and taxable services that are purchased, sold, leased or rented within the city of steamboat springs.

2

2

Housing Information For Residents Colorado Springs

New Downtown Parking Rates And Hours Go Into Effect Colorado Springs

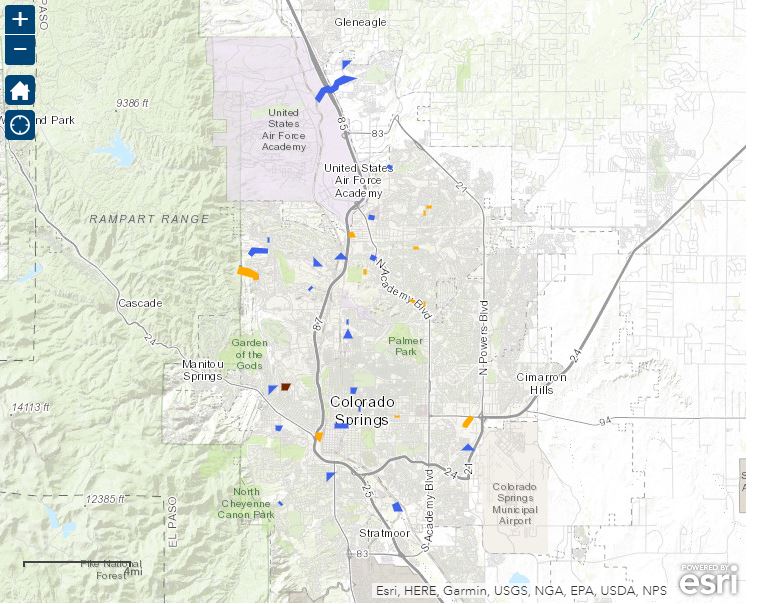

Stormwater Project Map Colorado Springs

2

Sales Tax Information Colorado Springs

Job Interest Cards Colorado Springs

Pin On Wilcoxson Auto Specials

Cheap Flights To Colorado Springs From 40 In 2021 - Kayak

Pin On Travel

Parade And Street Festival To Celebrate Colorado Springs 150th Anniversary Colorado Springs

Covid-19 Response Helping Businesses Colorado Springs

Shared E-scooter Pilot Program Colorado Springs

New Sign Will Greet Drivers As They Enter Colorado Springs Colorado Springs

Procurement Services Colorado Springs

Sales Tax Information Colorado Springs

2

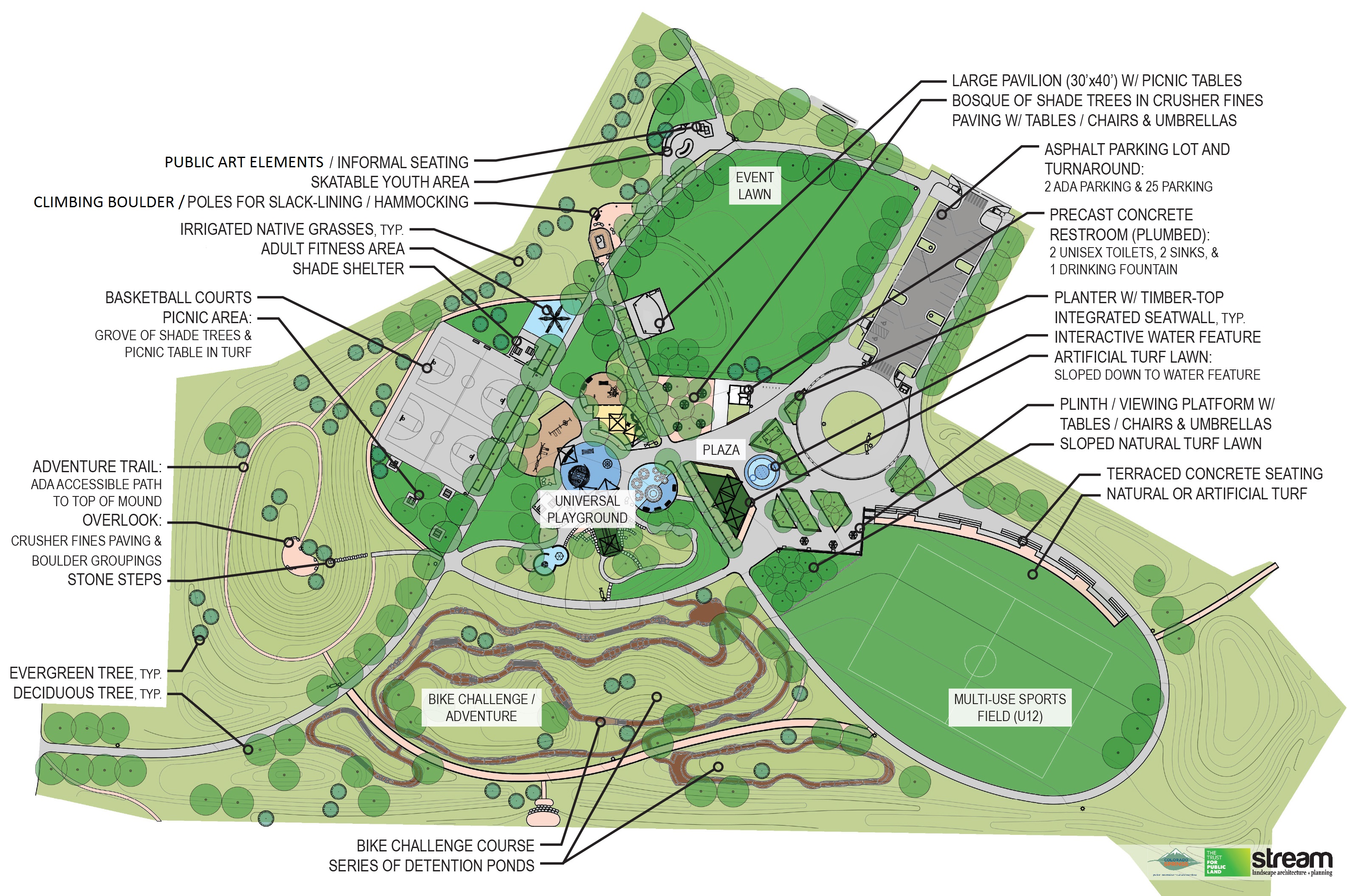

Panorama Park Renovation Colorado Springs

Colorado Springs Sales Tax License. There are any Colorado Springs Sales Tax License in here.